Ready to use legal template

Work on without any hassle

Indonesian-English translation

Ready to use legal template

Work on without any hassle

Indonesian-English translation

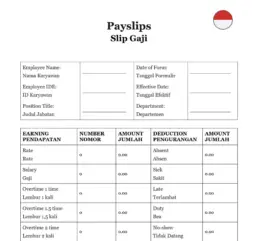

Home › Accounting › Payslip

Learn more about Payslip in Indonesia

A payslip is an official document provided by an employer to an employee that details the employee’s earnings, deductions, and net salary for a specific pay period. It serves as a transparent record of salary payments, including base pay, overtime, bonuses, taxes, and statutory deductions such as BPJS and income tax (PPh 21) in Indonesia. Payslips are essential for both employers and employees to maintain accurate payroll records and fulfill legal and tax obligations under Indonesian labor regulations. They are also commonly required for financial transactions such as loan applications or visa processes. Download our Payslip Form available in an easy to edit Word format and drafted by expert in English and Indonesian.

Table of contents

What is a Payslip in Indonesia?

In Indonesia, a Payslip, often referred to as a salary slip, is a document provided by employers to their employees each time they receive their salary. It serves as a detailed record of the employee’s gross pay, deductions, and the final net pay. Beyond just being a breakdown of earnings, the payslip also serves as a formal proof of employment, which can be crucial for various financial transactions and verifications. Given Indonesia’s unique payroll rules and regulations, the payslip becomes even more significant. It adheres to the Indonesian payroll calculation system, ensuring compliance with the country’s specific payroll laws. Therefore, a payslip in Indonesia is not just a statement of earnings but a comprehensive document that reflects the employee’s financial relationship with their employer.

Why is Payslip important?

A Payslip is an essential document in the employment process, serving multiple critical purposes.

Firstly, it acts as a transparent and accurate record of an employee’s earnings and deductions. This transparency allows employees to understand how their pay is calculated, including the various factors that contribute to their net pay. As a result, employees are better informed about their financial situation, enabling them to make informed decisions regarding budgeting, savings, and financial planning.

Secondly, payslips play a crucial role in ensuring compliance with labor laws and regulations. By accurately reflecting minimum wage requirements, overtime pay calculations, and paid time off accruals, payslips serve as evidence of legal compliance in case of audits or disputes. This adherence to legal obligations protects both employers from potential penalties and employees from unfair labor practices.

Lastly, payslips are essential for accurate payroll reconciliation and tax reporting. They provide a comprehensive record of each employee’s earnings and deductions, allowing payroll departments to reconcile pay periods, calculate tax withholdings, and prepare tax reports for both federal and state authorities. This accurate and timely recordkeeping ensures that employers meet their financial obligations and maintain a compliant payroll system.

What does Payslip contain in Indonesia?

Employers in Indonesia are required by law to furnish employees with payslips that include personal information such as proof of wages, tax paid, and any pension payments. The following fundamentals must be included:

| ➤ Gross pay is the original payment made before any taxes are deducted |

| ➤ Net pay, which is the amount you earn after taxes are subtracted |

| ➤ The payroll code: every employee is assigned a unique payroll number, which is frequently produced by the company's payroll software |

| ➤ Tax ID, pension ID, and social security number: If you are required by law to pay taxes or make donations, you will be granted a unique file number for the purpose of keeping records with government authorities, these are covered under the BPJS for healthcare and social security, which includes work accident insurance, life insurance, and pension benefits1. |

| ➤ Sick leave and other forms of leave may be billed individually on your pay stub |