Ready to use legal template

Work on without any hassle

Indonesian-English translation

Ready to use legal template

Work on without any hassle

Indonesian-English translation

Home › Accounting › Invoice

Learn more about Invoice in Indonesia

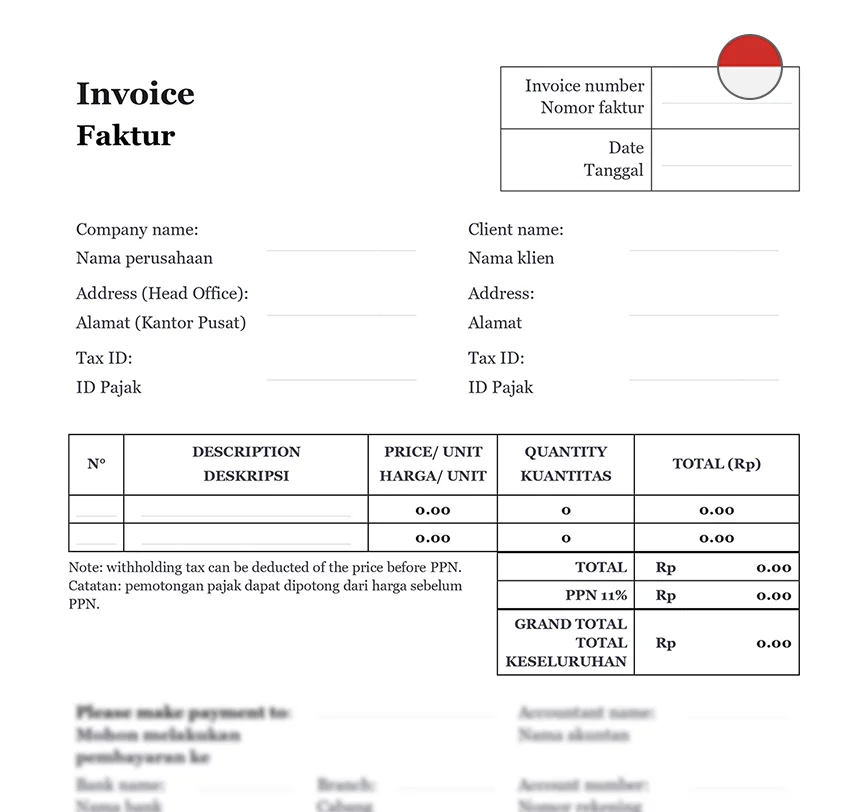

An Invoice is a formal document issued by a seller to a buyer that details goods or services provided, their costs, and payment terms. It serves as an essential record for businesses in Indonesia, ensuring transparent financial transactions and compliance with tax regulations. Invoices are crucial for tracking revenue, managing cash flow, and fulfilling legal requirements, including VAT reporting where applicable. In Indonesia, proper invoicing is particularly important for corporate tax filings and audits by tax authorities. Download our Invoice Form, easy to edit in Word format, professionally drafted in English and Indonesian, ensuring compliance with Indonesian accounting standards and tax regulations.

Table of contents

What is an Invoice in Indonesia?

An invoice is a document that the seller sends to the client to seek payment for goods or services. It is similar to a bill in that it states what items or services were supplied, how much they cost, and which payment methods the supplier accepts. Invoices are often provided to customers after they have received their products or services but prior to payment. As a result, they’re especially frequent among businesses that sell in bulk, such as manufacturers or wholesalers, and among freelancers who supply services rather than commodities, such as writers or graphic designers. Invoices, on the other hand, may be used by any firm, regardless of what they offer, when they need to bill clients after the transaction.

How to draft an Invoice?

Writing an invoice is actually rather straightforward, but there are a few key aspects that must be included with each and every invoice. One of the most significant distinctions between an invoice and a receipt is that invoices often contain more information about the transaction and its conditions than receipts. These are some examples:

| ➤ Name, logo, and contact information for your company |

| ➤ A distinct invoice number |

| ➤ The invoice's creation date |

| ➤ The payment deadline and any additional payment requirements |

| ➤ All allowed payment methods |

| ➤ A thorough description of the items and services acquired, including price and quantity |

| ➤ The entire amount owing, including any applicable taxes and fees |